On this page

What averaging accounting is

Averaging accounting is a carbon accounting method used in the ETS from 1 January 2023. It is used to work out how and when you will earn New Zealand Units (NZUs or units) for your post-1989 forest.

Carbon accounting is the process of calculating and reporting on the carbon stored in your forest. If you have post-1989 forest land in the ETS, this is how you know how many New Zealand Units (NZUs or units) you’ve earned or need to pay (surrender).

Find out more about earning and surrendering units

Find out about post-1989 forest land

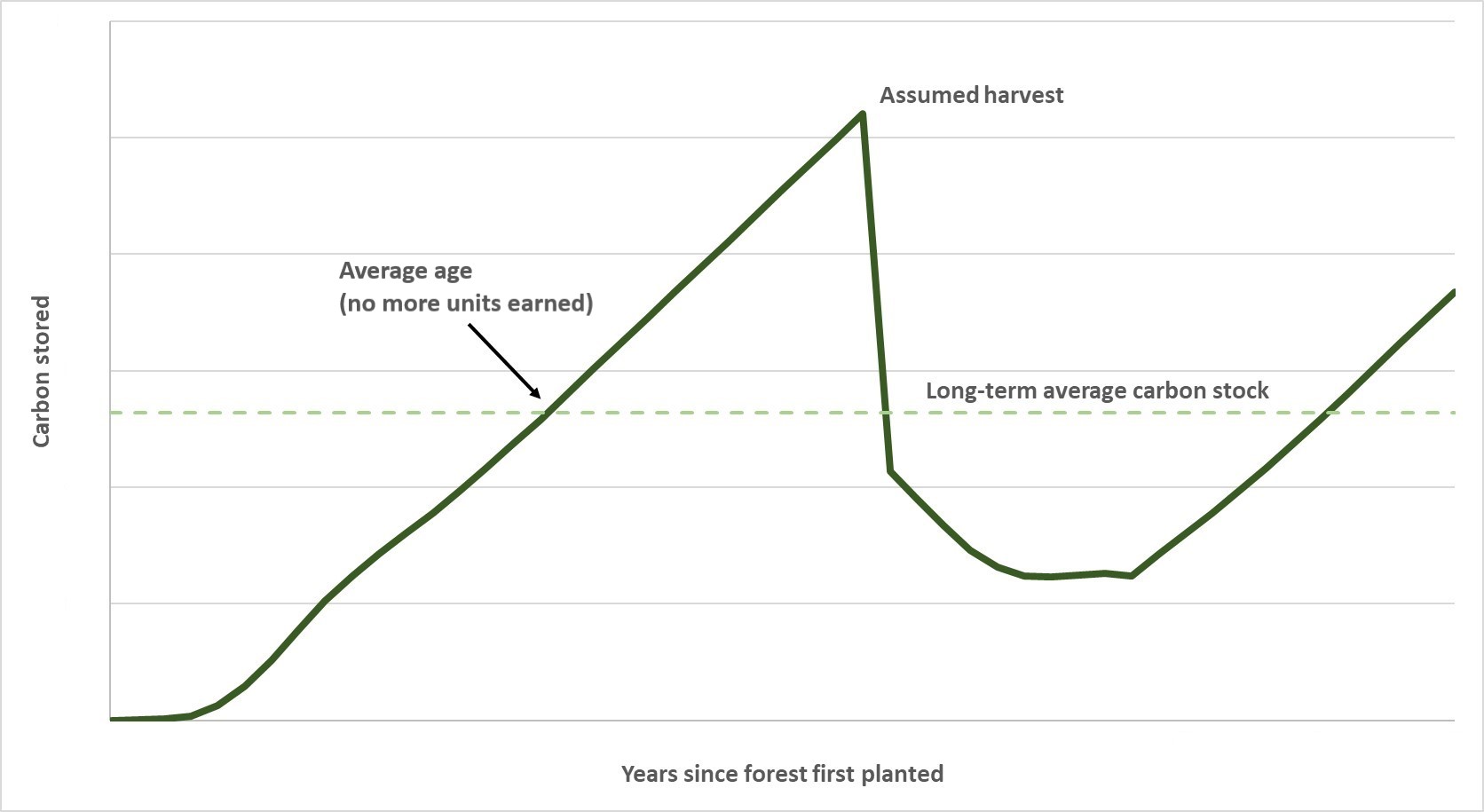

If your forest is registered under averaging accounting, you will earn units as your forest absorbs carbon until it reaches the amount of carbon it's expected to store in the long term. This is based on the average amount of carbon stored over many rotations (harvest cycles). In averaging accounting, there are specific rules around forest rotations and who can earn units.

This approach differs to the stock change accounting method. With stock change accounting, you earn and pay units based on calculations of the carbon stored in the forest at the time. Before 2023, stock change accounting was the only method used.

The carbon accounting method that applies to your forest land depends on when it was registered in the ETS.

Find out which carbon accounting method to use

Learn more about stock change accounting

Earning units under averaging accounting

Forests store a certain amount of carbon over multiple cycles of growth and harvest. We can average this amount to find the long-term average carbon stock. The age of the forest when it reaches its long-term carbon stock is called its "average age".

How forest rotations affect whether units can be earned

Whether you can earn units in averaging accounting depends on which rotation (harvest cycle) your forest is on.

First rotation

If your forest is on its first rotation, you will earn units until it reaches the average age for its forest type.

Find out what makes a forest "first rotation" under averaging accounting

Different forest species absorb carbon at different rates. Species are grouped into 5 forest types in the ETS. For exotic forest, the average age is based on typical harvesting ages in New Zealand. Each forest type in the ETS has its own average age:

- Radiata pine: age 16

- Douglas-fir: age 26

- Exotic softwoods: age 22

- Exotic hardwoods: age 12

- Native (indigenous) forest: age 23

Second or later rotation

If your forest is on its second or later rotation, you won’t earn any units under averaging accounting.

Earn units until the average age

You will earn units as your first-rotation forest grows, until it reaches its average age. You need to submit an emissions return to collect these units.

Find out more about earning and surrendering units in the ETS

You don't need to pay units after harvesting

If you harvest your first-rotation forest after the average age you will have earned units based on the forest’s average age. You will not need to pay units after you harvest, as long as you replant your forest.

You can also plant a different species or harvest at a different age during later rotations without having to pay units.

Fewer units for early harvests

Under averaging accounting, first-rotation forests that are cut down before they reach the average age for that forest type are treated as if they have a lower average age. This means you may have to pay some units back if you harvest early.

The age your forest is treated as having depends on the age it has when it’s cleared. There are 2 age bands before the average age:

Early clearing age bands

| Age band in which the first-rotation trees were cleared | Age the forest is considered to be for future carbon calculations using averaging accounting |

|---|---|

| 0-4 | 0 |

| 5-average age for that forest type | 5 |

No units earned after the average age

Under averaging accounting, once your forest reaches its average age you stop earning units.

This means that you will not earn any units for that forest land if you:

- register a first-rotation forest that is past its average age, or

- register a forest in its second or later rotation.

You don’t have to harvest your forest, but under averaging accounting you won’t earn extra units if it grows older than is typical for a forest of that type.

What makes a forest "first rotation" under averaging accounting

First-rotation forests are forests that have never been harvested. There is an exception under averaging accounting for some clearing of scrub and tree weeds.

If forest is planted onto land that was previously deforested, there are rules around when it can be counted as a first-rotation forest under averaging accounting. These rules apply to both land that was previously registered in the ETS and land that was not.

In the ETS, deforestation has a specific meaning. Land is deforested when it:

- is cleared and used for something else (such as pasture)

- has been left unstocked for 4, 10, or 20 years.

How the ETS defines deforestation

The date the land is deforested affects how the rules of averaging accounting apply. If it is considered deforested because it’s been unstocked for 4 years, the date of deforestation is 4 years after the trees were cleared.

If post-1989 forest land is registered in the ETS when you deforest it you have to pay units to the government.

Forest planted on land that was deforested before 2021

If the land was deforested before 2021, a new forest planted at any time counts as a first-rotation forest.

For example, if you harvested your forest in 2014 and left the land unstocked, it is considered deforested in 2018. If you then replanted in 2019 and haven’t since harvested, you have a first-rotation forest.

Forest planted on land that was deforested after 2021

This applies if post-1989 forest land:

- contained forest on 1 January 2021 and is then deforested, or

- was cleared (for example, harvested) before 1 January 2021 but is considered deforested after.

If you want to plant a new forest on this land and register it as a first-rotation forest, you can’t replant immediately. After deforesting, you must leave the land unstocked for 15 years. You can then plant a new forest and it will be considered to be on its first rotation. If you replant before 15 years have passed, it will count as a second or later rotation.

For example, if you harvested your forest in 2018 and left the land unstocked, it counts as deforested in 2022. Any new forest you plant after that will be second or later rotation, unless you wait until 2038 to plant.

Note: If the most recent forest on the land was pre-1990 forest land, this rule does not apply. If pre-1990 forest land was deforested and is now eligible to register as post-1989 forest land, it can be registered as first rotation forest without the 15-year stand-down period.

Clearing scrub and tree weeds on your forest land

When you are preparing to plant a new forest, you may be planning to clear regenerating forest, scrub, or tree weeds on your land.

Averaging accounting allows you to clear trees from your land without changing the rotation it’s on, as long as:

- the trees cleared were established by natural regeneration

- the trees are younger than the average age for that forest type.

This means you can clear self-seeded forest and plant new trees in its place. The new forest will still count as a first-rotation forest.

Accounting for the emissions from clearing scrub and tree weeds

If the land is registered in the ETS when you clear these trees, you’ll have to account for the emissions from clearing them. You’ll also have to account for the residual carbon from the decay of debris left after clearing. This debris is considered to decay over 10 years. It continues to emit carbon throughout that time.

If you register forest land in the ETS after clearing scrub but within the following 10 years, you’ll still need to account for the residual carbon.

Naturally regenerated forest in the Resource Management Act

Clearing of naturally regenerated forest must meet any requirements under the Resource Management Act.

Find out more about the Resource Management Act and forestry

Averaging accounting and other changes to the ETS

In September 2021, Cabinet made several major decisions about the regulations for averaging accounting and other new forestry provisions. These changes to the ETS were introduced by the Climate Change Response (Emissions Trading Reform) Amendment Act 2020.

Find out more about the legislative decisions for averaging accounting on our consultation page for the Amendment Act.

Legislative decisions in the Amendment Act

Cabinet paper and supporting information

New Emissions Trading Scheme (NZ ETS): Final Policy decisions for forestry (Cabinet paper) [PDF, 1.2 MB]

Appendix one of Cabinet paper: List of areas that require minor and technical updates [PDF, 592 KB]

Stumpage values across New Zealand [PDF, 919 KB]

Summaries of consultation submissions

A Better Emissions Trading Scheme for Forestry – Summary of submissions [PDF, 1.3 MB]

Find out more

Calculating carbon for post-1989 forest land under averaging accounting